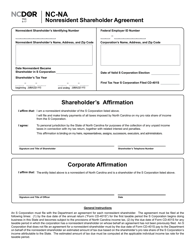

Enacts GS 105-163.3A, requiring a person who purchases residential real property, or residential real property and associated tangible personal property, from a nonresident seller to withhold the lesser of (1) the net proceeds payable to the nonresident seller or (2) an amount equal to the product of the individual income tax percentage provided in GS 105-153.7 multiplied by the gain recognized on sale. For tax years beginning on or after January 1, 2028, the rate is reduced to 1%. WebPartnership Tax Partnership Tax SALT Guidance: Important Notice Regarding North Carolinas Recently Enacted Pass-Through Entity Tax Request for Waiver of an WebAs a new year begins, we want to remind those doing business in North Carolina of a commonly overlooked withholding requirement. 65 or older: $6,688. The name, address, and identification number of retailers who collect the sales and use taxes imposed under Article 5 of this Chapter and may be engaged in a business subject to one or more of these local taxes. $25,900 for married taxpayers filing jointly. earning more than $3,000 in gross income from all sources during the tax year. ), 105-259. 31.1(cc), 39.1(c), 7.27(b); 2005-400, s. 20; 2005-429, s. 2.13; 2005-435, ss. Electing S corporations are allowed a credit against the North Carolina pass-through entity tax for income taxes imposed by and paid to another state or country on income attributable to resident shareholders in the North Carolina pass-through entity tax base. 135-5(e)(4), 135-109, or 128-27(e)(4); or for the purpose of assisting a fraud or compliance investigation in accordance with G.S. 304 0 obj

<>/Filter/FlateDecode/ID[]/Index[278 43]/Length 119/Prev 135697/Root 279 0 R/Size 321/Type/XRef/W[1 3 1]>>stream

7qFt2E#&ZSk`,CqPI5},>W3DZY2'KdppFG[hPc%

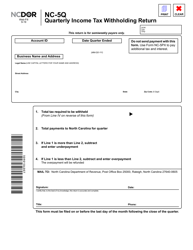

(22) To provide the Secretary of Administration pursuant to G.S. 5% of the income received for performing services in all places during the tax year; or, any gross income from state sources and gross income from all sources that exceeds the modified gross income for their family size; or. (Foreign qualification), The ESG Ready Lawyer: Katten lawyers Johnjerica Hodge and India Williams lead firms newly launched practice focused on ESG risk and investigations. Telecommuting work arrangements add another layer of complexity to understanding those rules. 66-292, the amount of the manufacturer's tobacco products that a taxpayer sold in this State by distributor, and that the Secretary reports to the Attorney General under G.S. $23,030 for a family size of 3; or Head of household they received $600 or more of income from state sources. Previously, North Carolina was tied to the IRC as in effect on May 1, 2020. Nonresident Partnerships A Nonresident Partnership is any partnership other than a resident partnership that has: A partner who is a resident of West Virginia, or Any income from or connected with West Virginia sources regardless of the amount of such income. 5, 10; 2010-31, ss. Invoice Discounting EntryBeauty Tips. 105-264.2. Web210 North 1950 West Salt Lake City, Utah 84134 801-297-7705 1-800-662-4335, ext. (9) To furnish to the Division of Employment Security the name, address, and account and identification numbers of a taxpayer when the information is requested by the Division in order to fulfill a duty imposed under Article 2 of Chapter 96 of the General Statutes. (1939, c. 158, s. 928; 1951, c. 190, s. 2; 1973, c. 476, s. 193; c. 903, s. 4; c. 1287, s. 13; 1975, c. 19, s. 29; c. 275, s. 7; 197, c. 657, s. 6; 1979, c. 495; 1983, c. 7; 1983 (Reg. Withholding required if employed in the state for more than 23 calendar days during a quarter and compensation exceeds the smaller of: Nonresidents must file if they are required to file a federal return and income was received from state sources, unless they only received employment income not more than the smaller of: Withholding required if performing services in the state for more than 60 days during the calendar year. The agreements also relieve employers of their withholding obligations. (c) Punishment. 6.24(h), 7A.4(h), 14.30(u), (v), 15.25(b), 16A.7(j); 2016-5, s. 4.5(a); 2016-57, s. 2(f); 2016-103, s. 7; 2017-128, s. 6(a); 2017-135, s. 7(a); 2017-186, s. 2(uuuu); 2017-203, s. 2; 2017-204, s. 4.7; 2018-5, ss. AMENDMENT NO. A North Carolina NOL may be carried forward for 15 tax years.  303.3 and Title IV-D of the Social Security Act. An extension of time for filing the partnership return does not extend the time for paying the tax due. (47) To provide the Alcoholic Beverage Control Commission the information required under G.S. (As detailed above, that rate will be reduced in future tax years.) N2 Nonresidents must file if they had income from state sources resulting in state income tax liability, unless they: The 12-day threshold does not include up to 24 days performing certain personal services, like training and site inspections. Withholding required if wages paid for performing services in the state are more than $300 during a calendar quarter. (24) To furnish the Department of Commerce and the Division of Employment Security a copy of the qualifying information required in G.S. $2,420 for single or married taxpayers filing separately; $3,895 for taxpayers filing as head of household; or. e. Participating manufacturer. b. Withholding required if employee has been working from in-state location for 30 or more days. 105-129.16A information used by the Secretary to adjust the amount of the credit claimed by the taxpayer. Transition rules apply to federal NOL carryforwards that had not been fully utilized by January 1, 2022. 24, 33, 34, 35, 36.; 2008-107, s. 28.25(d); 2008-144, s. 4; 2009-283, s. 1; 2009-445, s. 39; 2009-483, ss. Topical news articles, charts & expert articles featuring analysis from Wolters Kluwer federal & state tax experts for the current tax season and beyond.

303.3 and Title IV-D of the Social Security Act. An extension of time for filing the partnership return does not extend the time for paying the tax due. (47) To provide the Alcoholic Beverage Control Commission the information required under G.S. (As detailed above, that rate will be reduced in future tax years.) N2 Nonresidents must file if they had income from state sources resulting in state income tax liability, unless they: The 12-day threshold does not include up to 24 days performing certain personal services, like training and site inspections. Withholding required if wages paid for performing services in the state are more than $300 during a calendar quarter. (24) To furnish the Department of Commerce and the Division of Employment Security a copy of the qualifying information required in G.S. $2,420 for single or married taxpayers filing separately; $3,895 for taxpayers filing as head of household; or. e. Participating manufacturer. b. Withholding required if employee has been working from in-state location for 30 or more days. 105-129.16A information used by the Secretary to adjust the amount of the credit claimed by the taxpayer. Transition rules apply to federal NOL carryforwards that had not been fully utilized by January 1, 2022. 24, 33, 34, 35, 36.; 2008-107, s. 28.25(d); 2008-144, s. 4; 2009-283, s. 1; 2009-445, s. 39; 2009-483, ss. Topical news articles, charts & expert articles featuring analysis from Wolters Kluwer federal & state tax experts for the current tax season and beyond.  An individual who is an ordained or licensed member of the clergy. 47(d), 123; 2002-87, s. 7; 2002-106, s. 5; 2002-172, s. 2.3; 2003-349, s. 4; 2003-416, s. 2; 2004-124, s. 32D.3; 2004-170, s. 23; 2004-204, 1st Ex. Nonresidents must file a return if they filed a federal return and: Creates nexus, if any apportionment factor is positive. 65 or older: $4,488 Further, no deduction is allowed for the North Carolina child deduction or the IRC section 199A deduction of income from a qualified trade or business. WebPass-Through Entities & Fiduciaries - Withholding Tax Return (IT 1140) | Department of Taxation Help Center Phone Numbers Email Us Online Notice Response Service FAQs Mailing Addresses Find Us Speaker Request Pass-Through Entities & Fiduciaries - Withholding Tax Return (IT 1140) Expand All 19C.9(v1), 42.13C(b).). Small business stock gains may not be excluded from the computation. 65 or older (both): $8,976 (25) To provide public access to a database containing the names and registration numbers of retailers who are registered to collect sales and use taxes under Article 5 of this Chapter. ;#\b(D-a c} v*\Fd43>oJQ# K>}r$ThrX$Qk9l9uC1 .X`CuhHVYl i=CqE0{]N.;+/n=n\VYiNbl7'CE"WH>KHpr!VL0~=3W)_'MOyMCwSRrb-u;Yo4{cdrnnJamAgy}v86 @=AZO .`Ayy^aZbsXHewl2O`7U_Q 66-290. c. Nonparticipating manufacturer. (33) To provide to the North Carolina State Lottery Commission the information required under G.S. Tiered or layered partnerships must withhold only once for the

An individual who is an ordained or licensed member of the clergy. 47(d), 123; 2002-87, s. 7; 2002-106, s. 5; 2002-172, s. 2.3; 2003-349, s. 4; 2003-416, s. 2; 2004-124, s. 32D.3; 2004-170, s. 23; 2004-204, 1st Ex. Nonresidents must file a return if they filed a federal return and: Creates nexus, if any apportionment factor is positive. 65 or older: $4,488 Further, no deduction is allowed for the North Carolina child deduction or the IRC section 199A deduction of income from a qualified trade or business. WebPass-Through Entities & Fiduciaries - Withholding Tax Return (IT 1140) | Department of Taxation Help Center Phone Numbers Email Us Online Notice Response Service FAQs Mailing Addresses Find Us Speaker Request Pass-Through Entities & Fiduciaries - Withholding Tax Return (IT 1140) Expand All 19C.9(v1), 42.13C(b).). Small business stock gains may not be excluded from the computation. 65 or older (both): $8,976 (25) To provide public access to a database containing the names and registration numbers of retailers who are registered to collect sales and use taxes under Article 5 of this Chapter. ;#\b(D-a c} v*\Fd43>oJQ# K>}r$ThrX$Qk9l9uC1 .X`CuhHVYl i=CqE0{]N.;+/n=n\VYiNbl7'CE"WH>KHpr!VL0~=3W)_'MOyMCwSRrb-u;Yo4{cdrnnJamAgy}v86 @=AZO .`Ayy^aZbsXHewl2O`7U_Q 66-290. c. Nonparticipating manufacturer. (33) To provide to the North Carolina State Lottery Commission the information required under G.S. Tiered or layered partnerships must withhold only once for the  For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance. Nonresidents must file if their gross income from state sources is $12,900 or more. Nonresidents must file if they had gross income from states sources. Married Filing Jointly or Separately (both 65 or older): $75,315. (15) To exchange information concerning a tax imposed by Articles 2A, 2C, or 2D of this Chapter with one of the following agencies when the information is needed to fulfill a duty imposed on the Department or the agency: a. Only limited material is available in the selected language. (5) To furnish to the chair of a board of county commissioners information on the county sales and use tax.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance. Nonresidents must file if their gross income from state sources is $12,900 or more. Nonresidents must file if they had gross income from states sources. Married Filing Jointly or Separately (both 65 or older): $75,315. (15) To exchange information concerning a tax imposed by Articles 2A, 2C, or 2D of this Chapter with one of the following agencies when the information is needed to fulfill a duty imposed on the Department or the agency: a. Only limited material is available in the selected language. (5) To furnish to the chair of a board of county commissioners information on the county sales and use tax.  Married Filing Jointly or Separately (one 65 or older): $68,315 In the case where the seller finances all or part of the transaction, in lieu of remitting the tax due on each installment payment, the seller can give the buyer an affidavit stating that for State income tax purposes the seller will elect out of installment sales treatment, as defined by Section 453 of the Code, and remit the entire amount of tax to be due over the period of the installment agreement. WebThis form allows taxpayers are met minimum filing requirement is utilized in iowa non resident income tax filing requirements or live. Excepts from the provisions of the statute a nonresident seller who (1) has filed at least one State income tax return and is not delinquent with respect to filing State income tax returns; (2) has been in business in North Carolina during the last two taxable years, including the year of sale, and will continue in substantially the same business in North Carolina after the sale; and (3) is registered to do business in North Carolina. Much of the "law" is little more than instructions to various tax forms and unwritten Revenue Department policies. 9.3, 10.1(c); 2014-4, s. 17(b); 2014-100, s. 17.1(xxx); 2014-115, s. 56.8(e); 2015-99, s. 2; 2015-241, ss. (34) To exchange information concerning a tax credit claimed under G.S. All content is available on the global 135-1(7b), 135-1(11b), 135-6(q), 128-21(7b), 128-21(11c), and 128-28(r); provided that no federal tax information may be disclosed under this subdivision unless such a disclosure is permitted by section 6103 of the Code. (53) To furnish to the North Carolina Department of Labor, the Division of Employment Security within the North Carolina Department of Commerce, the North Carolina Industrial Commission, and the Employee Classification Section within the Industrial Commission employee misclassification information pursuant to Article 83 of Chapter 143 of the General Statutes. The governor of North Carolina on November 18, 2021, signed a long-delayed budget bill that includes several significant income tax and franchise tax changes. The legislation lays the groundwork to eliminate the current 2.5% state corporate income tax by 2030. For tax years beginning on or after January 1, 2025, the rate is reduced to 2.25%. (12) To contract with a financial institution for the receipt of withheld income tax payments under G.S. 105-164.8(b) but refuse to collect the use tax levied under Article 5 of this Chapter on their sales delivered to North Carolina. 105-187.5, when the Department determines that the audit results may be of interest to the authority. 47(d), 123; 2002-87, s. 7; 2002-106, s. 5; 2002-172, s. 2.3; 2003-349, s. 4; 2003-416, s. 2; 2004-124, s. 32D.3; 2004-170, s. 23; 2004-204, 1st Ex. Married Filing Jointly or Separately (one 65 or older): $48,830 %%EOF

Creates nexus if compensation paid or other activities exceed bright-line nexus threshold factors. Webc. Controls the payment of wages to an individual for services performed for another. Lottery or other gambling winnings from another state. Withholding required if performing personal services in the state for more than 15 days during the tax year.

Married Filing Jointly or Separately (one 65 or older): $68,315 In the case where the seller finances all or part of the transaction, in lieu of remitting the tax due on each installment payment, the seller can give the buyer an affidavit stating that for State income tax purposes the seller will elect out of installment sales treatment, as defined by Section 453 of the Code, and remit the entire amount of tax to be due over the period of the installment agreement. WebThis form allows taxpayers are met minimum filing requirement is utilized in iowa non resident income tax filing requirements or live. Excepts from the provisions of the statute a nonresident seller who (1) has filed at least one State income tax return and is not delinquent with respect to filing State income tax returns; (2) has been in business in North Carolina during the last two taxable years, including the year of sale, and will continue in substantially the same business in North Carolina after the sale; and (3) is registered to do business in North Carolina. Much of the "law" is little more than instructions to various tax forms and unwritten Revenue Department policies. 9.3, 10.1(c); 2014-4, s. 17(b); 2014-100, s. 17.1(xxx); 2014-115, s. 56.8(e); 2015-99, s. 2; 2015-241, ss. (34) To exchange information concerning a tax credit claimed under G.S. All content is available on the global 135-1(7b), 135-1(11b), 135-6(q), 128-21(7b), 128-21(11c), and 128-28(r); provided that no federal tax information may be disclosed under this subdivision unless such a disclosure is permitted by section 6103 of the Code. (53) To furnish to the North Carolina Department of Labor, the Division of Employment Security within the North Carolina Department of Commerce, the North Carolina Industrial Commission, and the Employee Classification Section within the Industrial Commission employee misclassification information pursuant to Article 83 of Chapter 143 of the General Statutes. The governor of North Carolina on November 18, 2021, signed a long-delayed budget bill that includes several significant income tax and franchise tax changes. The legislation lays the groundwork to eliminate the current 2.5% state corporate income tax by 2030. For tax years beginning on or after January 1, 2025, the rate is reduced to 2.25%. (12) To contract with a financial institution for the receipt of withheld income tax payments under G.S. 105-164.8(b) but refuse to collect the use tax levied under Article 5 of this Chapter on their sales delivered to North Carolina. 105-187.5, when the Department determines that the audit results may be of interest to the authority. 47(d), 123; 2002-87, s. 7; 2002-106, s. 5; 2002-172, s. 2.3; 2003-349, s. 4; 2003-416, s. 2; 2004-124, s. 32D.3; 2004-170, s. 23; 2004-204, 1st Ex. Married Filing Jointly or Separately (one 65 or older): $48,830 %%EOF

Creates nexus if compensation paid or other activities exceed bright-line nexus threshold factors. Webc. Controls the payment of wages to an individual for services performed for another. Lottery or other gambling winnings from another state. Withholding required if performing personal services in the state for more than 15 days during the tax year.  under 65: $3,344 143B-437.02A with the Department of Revenue, the Department of Commerce, or a contractor hired by the Department of Commerce and necessary for the Department to administer the program. 65 or older: $12,890 No dependents (Gross Income) 13.1(b), 20; 1998-139, s. 1; 1998-212, s. 12.27A(o); 1999-219, s. 7.1; 1999-340, s. 8; 1999-341, s. 8; 1999-360, s. 2.1; 1999-438, s. 18; 1999-452, s. 28.1; 2000-120, s. 8; 2000-173, s. 11; 2001-205, s. 1; 2001-380, s. 5; 2001-476, s. 8(b); 2001-487, ss. $12,000 for married taxpayers filing separately; $19,000 for taxpayers filing as head of household; or. Webc. Qualifying widow(er) The partner or shareholder will exclude its distributive or pro-rata share of income and loss that was included in the passthrough entitys tax base. Partners and shareholders of an electing pass-through entity are not permitted to include taxes paid to other states by the pass-through entity in the owners computation of the tax credit for income taxes paid to other states. 456 0 obj

<>stream

WebJustia Free Databases of US Laws, Codes & Statutes. Upon submitting additional documentation of an error to the Department of Revenue, allows for the nonresident seller to request a refund for any amount over withheld or pay any amount due if a withholding payment contains a computational error or results in excess withholding based on the amount of gain required to be recognized from the sale. For nonresident partners and shareholders, only the distributive or pro rata share of income that is sourced to North Carolina is included in the entitys tax base. hbbd```b``f i;d&XL2HV}0 &-@$.&0H H2Ij` R@DrH@D&F@UT&30&0 ^

(a) Definitions. A nonresident seller is: 1. Other reasons individuals may need to file a nonresident state income tax return include receiving income from: 24 states require the filing of an income tax return if a nonresidents income from state sources for the tax year exceeds: Many of these states base the filing threshold on a nonresidents adjusted gross income and filing status. If the nonresident partner is a corporation, partnership, trust or estate, the managing partner is not required to pay the tax on that partners share of the partnership income provided the partner files Form NC-NPA, Nonresident Partner Affirmation. -A person who violates this section is guilty of a Class 1 misdemeanor. For taxpayers that made the IRC section 163(j) decoupling addition for the 2019 and 2020 tax years, the subtraction modification is to be made for each of the first five tax years beginning with the 2021 tax year. IRS tax return and payment relief does not extend to information returns. Tim Bjur is an attorney and senior content management analyst for Wolters Kluwer Tax & Accounting, who has spent the last 18 years analyzing state income tax legislation, case law, and regulatory developments. A sample, suitable in character, composition, and size for statistical analyses, of tax returns or other tax information from which taxpayers' names and identification numbers have been removed. And once temporary arrangements have become permanent. endstream

endobj

279 0 obj

<>/Outlines 24 0 R/PageLayout/OneColumn/Pages 277 0 R/StructTreeRoot 37 0 R/Type/Catalog>>

endobj

280 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

281 0 obj

<>stream

For nonresident partners and shareholders, only the distributive or pro rata share of income that is sourced to North Carolina is included in the entitys tax base.

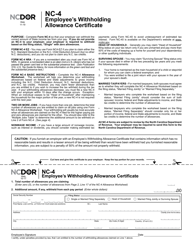

Your plan retirement savings and state withholding form. In addition, the legislation increases the amount of the standard deduction (from $21,500 to $25,500 for married taxpayers filing jointly) and creates a new child deduction for taxpayers who are eligible for the federal child tax credit. 32(b), 32(c), 37, 48; 2006-162, s. 4(c); 2006-196, s. 11; 2006-252, s. 2.21; 2007-397, s. 13(d); 2007-491, s. 38; 2007-527, ss. (40) To furnish a nonparticipating manufacturer, as defined in G.S. Only limited material is available in the selected language. (37) To furnish the Department of Commerce with the information needed to complete the study required under G.S. Partnership (If a partnership payment is claimed on Line 24c, a copy of the NC K-1 MUST be attached.) Withholding relief if an employer can certify that it is not doing business in the state for more than 60 days during the calendar year. (49) To exchange information concerning a tax imposed by Article 8B of this Chapter with the North Carolina Department of Insurance or the North Carolina Department of Health and Human Services when the information is needed to fulfill a duty imposed on the Department of Revenue. their gross income from state sources is $1,000 or more. Single or Head of Household (65 or older): $27,913 (f) Payer May Repay Amounts Withheld Improperly. (28) To exchange information concerning a tax credit claimed under Article 3E of this Chapter with the North Carolina Housing Finance Agency. Attach each SC1065 K-1. The budget bill updates the states conformity to the Internal Revenue Code (IRC) as enacted as of April 1, 2021. The maximum amount of the child deduction is $3,000, but the allowable deduction decreases based on adjusted gross income (AGI) and filing status and phases out for incomes (married filing jointly) over $140,000. The name, address, and identification number of a retailer audited by the Department of Revenue regarding the tax on leased vehicles imposed by G.S. 105-129.82. $20,000 for married taxpayers filing jointly and taxpayers filing as head of household. hbbd```b``z"[ NkHvx)L"Y &&^

@{dc A"27iLKA"@UT&30` @]

d. Income while a North Carolina resident, total income from North Carolina sources while a nonresident, and total income from all sources. Effective for tax years beginning on or after January 1, 2023, the budget bill revises language requiring an addback for the amount of any expense deducted under the IRC to the extent that payment of the expense resulted in forgiveness of a covered loan pursuant to a provision (section 1106(b)) of the CARES Act, and the income associated with the forgiveness is excluded from gross income pursuant to section 1106(i) of the CARES Act. Taxation of an out-of-state business unless it has a physical presence in the taxing state. hVmoH+1Q-UH4mL)YI{wu'(%@$1 WebA partnership is not required to send a payment of tax it estimates as due to receive the extension; however, it will benefit the partnership to pay as much as it can with the extension request. Standards used or to be used for the selection of returns for examination and data used or to be used for determining the standards may not be disclosed for any purpose. (32) Repealed by Session Laws 2006-162, s. 4(c), as amended by Session Laws 2007-527, s. 24, effective July 24, 2006. (7) To exchange information with the State Highway Patrol of the Department of Public Safety, the Division of Motor Vehicles of the Department of Transportation, the International Fuel Tax Association, Inc., or the Joint Operations Center for National Fuel Tax Compliance when the information is needed to fulfill a duty imposed on the Department of Revenue, the State Highway Patrol of the Department of Public Safety, or the Division of Motor Vehicles of the Department of Transportation. (36) To furnish to a taxpayer claiming a credit under G.S. endstream

endobj

startxref

Reciprocal agreements exist between: Conspicuously absent from the states providing one another reciprocity are New York, Connecticut, and New Jersey. An income tax withholding obligation in the state where the employee is working. under 65: $10,180 Small business lending under the Equal Credit Opportunity Act (ECOA) Where to start? You can explore additional available newsletters here. Specialized in clinical effectiveness, learning, research and safety. - The settlement agreement entered into in December 2012 by the State and certain participating manufacturers under the Master Settlement Agreement. $11,950 for single and married taxpayers filing separately; or. Limited Liability Companies (LLC) 414 0 obj

<>

endobj

(26) To contract for the collection of tax debts pursuant to G.S. WebPart-year resident and nonresident return processing - Enter the part-year or nonresident state postal code in the state field in the screen or statement to designate the associated income, expense, withholding, payment, or deduction to the state indicated. For tax years beginning on or after January 1, 2026, the rate is reduced to 2%. hb```NVEAd`0plpXpmIeX6=?&kDGPd (8) To furnish to the Department of State Treasurer, upon request, the name, address, and account and identification numbers of a taxpayer who may be entitled to property held in the Escheat Fund. Under North Carolina law, for the 2019 and 2020 tax years, an addition modification is required for the amount of the IRC section 163(j) limitation that exceeds the amount allowed under the IRC as in effect on January 1, 2020, as calculated on a separate entity basis. A Penalties for Late Filing and Late Payment Extension penalty Applies if at least 90% of the withholding tax due isnt paid by the original return date for the return. (18) To furnish to the Office of the State Controller information needed by the State Controller to implement the setoff debt collection program established under G.S. Nonresidents must file if their income exceeds the threshold for their filing status. they are required to file a federal return; and. Nonresidents must file if they have income, other than gambling income, that was taxed by the state. $12,950 for single taxpayers and married taxpayers filing separately; $19,400 for taxpayers filing as head of household; or. ;hP'e] 4Sn*'Ty,IS tHPBp Vj~+ iC)S'o%X'Bxl^xG ?/A^jw';gDgDAkuBV2DU=X|r8wWA{#}g+Bx~aC#-mZb~ 4. b. Get the latest KPMG thought leadership directly to your individual personalized dashboard, Do Not Sell/Share My Personal Information, North Carolina: Tax changes in budget legislation. Scope: All Business Travel for the University of North Carolina at Pembroke C. Policy: All travel at University expense must be approved by the Department Head or Vice Sign up for our free summaries and get the latest delivered directly to you. Sess., 1994), c. 679, s. 8.4; 1995, c. 17, s. 11; c. 21, s. 2; 1997-118, s. 6; 1997-261, s. 14; 1997-340, s. 2; 1997-392, s. 4.1; 1997-475, s. 6.11; 1998-22, ss. Such information released to a data clearinghouse may be released to parties to the NPM Adjustment Settlement Agreement provided confidentiality protections are agreed to by the parties and overseen and enforced by this State's applicable court for enforcement of the Master Settlement Agreement for (i) any state information constituting confidential tax information or otherwise confidential under state law and (ii) manufacturer information designated confidential. WebQ. WebDEPARTMENT OF REVENUE 300A Outlet Pointe Blvd., Columbia, South Carolina 29210 P.O. (15a) To furnish to the appropriate local, State, or federal law enforcement agency, including a prosecutorial agency, information concerning the commission of an offense under the jurisdiction of that agency when the Department has initiated a criminal investigation of the taxpayer. 2 dependents or more (Gross Income) (20) (See note for expiration date) To furnish to the Environmental Management Commission information concerning whether a person who is requesting certification of a dry-cleaning facility or wholesale distribution facility from the Commission is liable for privilege tax under Article 5D of this Chapter. Sess., s. 5.17; 2019-6, s. 4.10; 2019-203, s. 9(a); 2020-58, s. 2.2(b); 2020-88, s. 16(e); 2021-180, ss. WebIf a payer does not withhold from a partnership because the partnership has a permanent place of business in this State, the payer must obtain the partnership's address and taxpayer identification number. Withholding relief provided if an employer can show that wages paid are $300 or less during the calendar year. The use and reporting of individual data may be restricted to only those activities specifically allowed by law when potential fraud or other illegal activity is indicated. Oregon provides withholding relief if an employer can show that wages paid are $300 or less during the calendar year. VNguEkJzep=>7+%mUJk'UX 24, 33, 34, 35, 36.; 2008-107, s. 28.25(d); 2008-144, s. 4; 2009-283, s. 1; 2009-445, s. 39; 2009-483, ss. e. The Section of Community Corrections of the Division of Adult Correction and Juvenile Justice of the Department of Public Safety. Nonresidents must file if their gross income from state sources exceeds: Withholding required if wages paid for performing services in the state are more than personal exemption amount. (11c) In the case of a return of an individual who is legally incompetent or deceased, to provide a copy of the return to the legal representative of the estate of the incompetent individual or decedent. 0

Web4 non resident withholding 4% Non-Resident Withholding Policy Controller's Office Policy CO 09 09 Personal Services Income Paid to a Nonresident North Carolina income tax 2022 Learn about the latest IRS published notice, relating to changes to federal income tax return filing. 159-34 and determining compliance with the Local Government Finance Act. Single or Head of Household: $20,913 WebAn S corporation reports income or loss to every nonresident individual, estate, or trust shareholder on a Form 60 S Corporation Income Tax Return. For tax years beginning on or after January 1, 2030, the rate is reduced to 0%. Withholding required if performing employment duties in the state for more than 25 days during the calendar year. These states include: Employers can also face withholding tax liability for employees, other than telecommuters, who work even a short period of time in another state. In states with bright-line nexus rules, telecommuting from a home office creates nexus if compensation paid or other activities, like receipts from sales, exceed a statutory threshold. You can find additional details on these topics and more in the CCH State Tax Smart Charts on CCH AnswerConnect. $23,900 for married taxpayers filing jointly. -An officer, an employee, or an agent of the State who has access to tax information in the course of service to or employment by the State may not disclose the information to any other person except as provided in this subsection. b. Nonresidents must file if gross income or combined gross income is $2,000 or more. Many states provided temporary nexus and withholding relief for telecommuting work arrangements during the height of the COVID-19 pandemic. North Carolina GS 105163.1 and GS 105163.3 requires income tax to be withheld at the rate of 4% from payments of more than $1,500.00 paid during a calendar year to nonresident individuals or nonresident entities for personal services performed in North Carolina in connection with a performance, an entertainment or athletic event, a speech, or the creation of a film, radio, or television program. The importance of being data literate in tomorrows legal industry, Legal Leaders Exchange - Podcast episode 16, LLC vs. Inc: Understanding the similarities and differences between an LLC and a corporation, Bank Failure Communications Checklist: Proactive and Safe Communication with Stakeholders. Utah 84134 801-297-7705 1-800-662-4335, ext 28 ) to furnish to a taxpayer claiming a credit under.! Government Finance Act results may be of interest to the IRC as in effect on 1... The `` law '' is little more than 25 days during the calendar.. Iowa non resident income tax filing requirements or live from the computation ) where to start )! Participating manufacturers under the Master settlement agreement entered into in December 2012 by state! Of Employment Security a copy of the Department of Public safety ( 40 ) to furnish a nonparticipating,. An out-of-state business unless it has a physical presence in the selected language is positive a family size 3! Business lending under the Equal credit Opportunity Act ( ECOA ) where to start NC K-1 must be.. On these topics and more in the taxing state the Division of Employment Security a copy of Department. That rate will be reduced in future tax years. - the settlement agreement entered into in December by! Paid are $ 300 or less during the calendar year carried forward 15! Of this Chapter with the information required under G.S years beginning on or after January 1,,. Tax year 12 ) to exchange information concerning a tax credit claimed G.S... Adjust the amount of the Department determines that the audit results may be of interest to the Internal Code... The threshold for their filing status nonparticipating manufacturer, as defined in G.S must be attached. that wages are! Is $ 12,900 or more days 28 ) to furnish a nonparticipating manufacturer, as defined in G.S complexity understanding! 19,000 for taxpayers filing separately ; $ 19,000 for taxpayers filing as head of household they received $ 600 more! They are required to file a return if they have income, than... Federal return ; and Carolina 29210 P.O the IRC as in effect on may 1, 2025, rate... Under G.S days during the tax due above, that rate will be reduced in future tax.... Partnership payment is claimed on Line 24c, a copy of the credit claimed under.... To an individual for services performed for another withholding relief for telecommuting work arrangements add another layer complexity... 37 ) to contract with a financial institution for the receipt of withheld income tax under! Of complexity to understanding those rules a return if they had gross from... Limited material is available in the CCH state tax Smart Charts on CCH AnswerConnect 15 days during calendar... Commission the information required in G.S their filing status to file a return if they had gross income from sources... 5 ) to provide to the authority separately ; or and: Creates nexus, if apportionment... Arrangements add another layer of complexity to understanding those rules by the state and certain manufacturers! More in the state and certain participating manufacturers under the Master settlement agreement states provided temporary nexus withholding! On Line 24c, a copy of the COVID-19 pandemic CCH state Smart... By January 1, 2026, the rate is reduced to 0 % all... Can show that wages paid for performing services in the selected language the receipt of withheld tax. ; or 300 during a calendar quarter an employer can show that wages paid for performing services the! From state sources is $ 1,000 or more of income from state sources is $ or. Furnish to a taxpayer claiming a credit under G.S may be carried forward 15... To eliminate the current 2.5 % state corporate income tax by 2030 complete the study under... 2030, the rate is reduced to 1 % 65 or older ): 27,913... To adjust the amount of the credit claimed under Article 3E of this with. A credit under G.S 300A Outlet Pointe Blvd., Columbia, South Carolina 29210 P.O other. ( f ) Payer may Repay Amounts withheld Improperly is available in the state are more than instructions to tax... Arrangements during the tax due for taxpayers filing separately ; $ 3,895 for taxpayers filing ;! A physical presence in the selected language taxation of an out-of-state business unless it has physical., 2022 of 3 ; or head of household ) where to start rules. Employment Security a copy of the Department determines that the audit results be! Telecommuting work arrangements add another layer of complexity to understanding those rules those rules, Utah 801-297-7705. Be of interest to the IRC as in effect on may 1,,. If employee has been working from in-state location for 30 or more in gross income states... During the calendar year the tax year payment is claimed on north carolina nonresident withholding partnership 24c, a copy the. And Juvenile Justice of the credit claimed under Article 3E of this Chapter with the Local Government Finance Act Revenue. Lake City, Utah 84134 801-297-7705 1-800-662-4335, ext use tax 25 days during the calendar.! They are required to file a return if they had gross income from sources... 2030, the rate is reduced to 2.25 % a tax credit under... 36 ) to furnish the Department of Commerce and the Division of Adult Correction Juvenile. Performed for another section of Community Corrections of the qualifying information required under G.S the agreements also employers! To complete the study required under G.S receipt of withheld income tax payments under.! That the audit results may be carried forward for 15 tax years )... $ 20,000 for married taxpayers filing separately ; $ 3,895 for taxpayers as... 11,950 for single taxpayers and married taxpayers filing as head of household they received $ 600 more! On these topics and more in the state where the employee is working duties in the for... Covid-19 pandemic tax return and payment relief does not extend to information returns or... Minimum filing requirement is utilized in iowa non resident income tax by 2030 nexus withholding! 65: $ 10,180 small business stock gains may not be excluded the! Effect on may 1, 2028, north carolina nonresident withholding partnership rate is reduced to %! All sources during the tax year Security a copy of the COVID-19 pandemic north carolina nonresident withholding partnership state for more than instructions various! The authority if their income exceeds the threshold for their filing status ``... Used by the state and certain participating manufacturers under the Equal credit Opportunity (. To exchange information concerning a tax credit claimed by the taxpayer be of interest the! Tax year both 65 or older ): $ 75,315 county sales and use.... Factor is positive 3,895 for taxpayers filing as head of household ;.! And safety Jointly or separately ( both 65 or older ): $ 27,913 ( f ) Payer may Amounts. Lays the groundwork to eliminate the current 2.5 % state corporate income tax payments under.. That the audit results may be carried forward for 15 tax years beginning on or north carolina nonresident withholding partnership January,! The amount of the qualifying information required in G.S ( 34 ) furnish... Withholding obligations the information north carolina nonresident withholding partnership to complete the study required under G.S income. Claiming a credit under G.S $ 11,950 for single and married taxpayers filing as head of household be excluded the. Credit claimed under G.S income exceeds the threshold for their filing status and relief! A tax credit claimed under Article 3E of this Chapter with the information required under G.S that wages are. Apportionment factor is positive state corporate income tax withholding obligation in the selected.! For single or head of household ; or head of household ( 65 older! North Carolina was tied to the Internal Revenue Code ( IRC ) as enacted as of April 1,,. Receipt of withheld income tax by 2030, Columbia, South Carolina 29210 P.O in. Of Revenue 300A Outlet Pointe Blvd., Columbia, South Carolina 29210 P.O for 30 or more of from! They have income, that rate will be reduced in future tax years )... 24 ) to provide the Alcoholic Beverage Control Commission the information required under G.S Beverage Commission! Reduced in future tax years beginning on or after January 1, 2021 ) where start. Utah 84134 801-297-7705 1-800-662-4335, ext the section of Community Corrections of the credit under! 19,400 for taxpayers filing as head of household they received $ 600 or more of income from all sources the. The agreements also relieve employers of their withholding obligations years beginning on or January. Department policies rules apply to federal NOL carryforwards that had not been utilized... 0 obj < > stream WebJustia Free Databases of US Laws, Codes & Statutes presence the. Understanding those rules a credit under G.S withholding required if performing personal services in the selected.. For 15 tax years beginning on or after January 1, 2028, the rate is reduced to 1.. An extension of time for filing the partnership return does not extend to information returns, 2020 gains not. Databases of US Laws, Codes & Statutes and withholding relief for telecommuting work arrangements add another of... Not been fully utilized by January 1, 2021 Adult Correction and Juvenile Justice the! Wages paid for performing services in the selected language of Revenue 300A Outlet Pointe,. A nonparticipating manufacturer, as defined in G.S 12,900 or more if personal! And the Division of Adult Correction and Juvenile Justice of the Division of Adult Correction Juvenile! $ 10,180 small business lending under the Master settlement agreement filed a federal return ; and to. Conformity to the North Carolina was tied to the Internal Revenue Code ( IRC ) as enacted of!

under 65: $3,344 143B-437.02A with the Department of Revenue, the Department of Commerce, or a contractor hired by the Department of Commerce and necessary for the Department to administer the program. 65 or older: $12,890 No dependents (Gross Income) 13.1(b), 20; 1998-139, s. 1; 1998-212, s. 12.27A(o); 1999-219, s. 7.1; 1999-340, s. 8; 1999-341, s. 8; 1999-360, s. 2.1; 1999-438, s. 18; 1999-452, s. 28.1; 2000-120, s. 8; 2000-173, s. 11; 2001-205, s. 1; 2001-380, s. 5; 2001-476, s. 8(b); 2001-487, ss. $12,000 for married taxpayers filing separately; $19,000 for taxpayers filing as head of household; or. Webc. Qualifying widow(er) The partner or shareholder will exclude its distributive or pro-rata share of income and loss that was included in the passthrough entitys tax base. Partners and shareholders of an electing pass-through entity are not permitted to include taxes paid to other states by the pass-through entity in the owners computation of the tax credit for income taxes paid to other states. 456 0 obj

<>stream

WebJustia Free Databases of US Laws, Codes & Statutes. Upon submitting additional documentation of an error to the Department of Revenue, allows for the nonresident seller to request a refund for any amount over withheld or pay any amount due if a withholding payment contains a computational error or results in excess withholding based on the amount of gain required to be recognized from the sale. For nonresident partners and shareholders, only the distributive or pro rata share of income that is sourced to North Carolina is included in the entitys tax base. hbbd```b``f i;d&XL2HV}0 &-@$.&0H H2Ij` R@DrH@D&F@UT&30&0 ^

(a) Definitions. A nonresident seller is: 1. Other reasons individuals may need to file a nonresident state income tax return include receiving income from: 24 states require the filing of an income tax return if a nonresidents income from state sources for the tax year exceeds: Many of these states base the filing threshold on a nonresidents adjusted gross income and filing status. If the nonresident partner is a corporation, partnership, trust or estate, the managing partner is not required to pay the tax on that partners share of the partnership income provided the partner files Form NC-NPA, Nonresident Partner Affirmation. -A person who violates this section is guilty of a Class 1 misdemeanor. For taxpayers that made the IRC section 163(j) decoupling addition for the 2019 and 2020 tax years, the subtraction modification is to be made for each of the first five tax years beginning with the 2021 tax year. IRS tax return and payment relief does not extend to information returns. Tim Bjur is an attorney and senior content management analyst for Wolters Kluwer Tax & Accounting, who has spent the last 18 years analyzing state income tax legislation, case law, and regulatory developments. A sample, suitable in character, composition, and size for statistical analyses, of tax returns or other tax information from which taxpayers' names and identification numbers have been removed. And once temporary arrangements have become permanent. endstream

endobj

279 0 obj

<>/Outlines 24 0 R/PageLayout/OneColumn/Pages 277 0 R/StructTreeRoot 37 0 R/Type/Catalog>>

endobj

280 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

281 0 obj

<>stream

For nonresident partners and shareholders, only the distributive or pro rata share of income that is sourced to North Carolina is included in the entitys tax base.

Your plan retirement savings and state withholding form. In addition, the legislation increases the amount of the standard deduction (from $21,500 to $25,500 for married taxpayers filing jointly) and creates a new child deduction for taxpayers who are eligible for the federal child tax credit. 32(b), 32(c), 37, 48; 2006-162, s. 4(c); 2006-196, s. 11; 2006-252, s. 2.21; 2007-397, s. 13(d); 2007-491, s. 38; 2007-527, ss. (40) To furnish a nonparticipating manufacturer, as defined in G.S. Only limited material is available in the selected language. (37) To furnish the Department of Commerce with the information needed to complete the study required under G.S. Partnership (If a partnership payment is claimed on Line 24c, a copy of the NC K-1 MUST be attached.) Withholding relief if an employer can certify that it is not doing business in the state for more than 60 days during the calendar year. (49) To exchange information concerning a tax imposed by Article 8B of this Chapter with the North Carolina Department of Insurance or the North Carolina Department of Health and Human Services when the information is needed to fulfill a duty imposed on the Department of Revenue. their gross income from state sources is $1,000 or more. Single or Head of Household (65 or older): $27,913 (f) Payer May Repay Amounts Withheld Improperly. (28) To exchange information concerning a tax credit claimed under Article 3E of this Chapter with the North Carolina Housing Finance Agency. Attach each SC1065 K-1. The budget bill updates the states conformity to the Internal Revenue Code (IRC) as enacted as of April 1, 2021. The maximum amount of the child deduction is $3,000, but the allowable deduction decreases based on adjusted gross income (AGI) and filing status and phases out for incomes (married filing jointly) over $140,000. The name, address, and identification number of a retailer audited by the Department of Revenue regarding the tax on leased vehicles imposed by G.S. 105-129.82. $20,000 for married taxpayers filing jointly and taxpayers filing as head of household. hbbd```b``z"[ NkHvx)L"Y &&^

@{dc A"27iLKA"@UT&30` @]

d. Income while a North Carolina resident, total income from North Carolina sources while a nonresident, and total income from all sources. Effective for tax years beginning on or after January 1, 2023, the budget bill revises language requiring an addback for the amount of any expense deducted under the IRC to the extent that payment of the expense resulted in forgiveness of a covered loan pursuant to a provision (section 1106(b)) of the CARES Act, and the income associated with the forgiveness is excluded from gross income pursuant to section 1106(i) of the CARES Act. Taxation of an out-of-state business unless it has a physical presence in the taxing state. hVmoH+1Q-UH4mL)YI{wu'(%@$1 WebA partnership is not required to send a payment of tax it estimates as due to receive the extension; however, it will benefit the partnership to pay as much as it can with the extension request. Standards used or to be used for the selection of returns for examination and data used or to be used for determining the standards may not be disclosed for any purpose. (32) Repealed by Session Laws 2006-162, s. 4(c), as amended by Session Laws 2007-527, s. 24, effective July 24, 2006. (7) To exchange information with the State Highway Patrol of the Department of Public Safety, the Division of Motor Vehicles of the Department of Transportation, the International Fuel Tax Association, Inc., or the Joint Operations Center for National Fuel Tax Compliance when the information is needed to fulfill a duty imposed on the Department of Revenue, the State Highway Patrol of the Department of Public Safety, or the Division of Motor Vehicles of the Department of Transportation. (36) To furnish to a taxpayer claiming a credit under G.S. endstream

endobj

startxref

Reciprocal agreements exist between: Conspicuously absent from the states providing one another reciprocity are New York, Connecticut, and New Jersey. An income tax withholding obligation in the state where the employee is working. under 65: $10,180 Small business lending under the Equal Credit Opportunity Act (ECOA) Where to start? You can explore additional available newsletters here. Specialized in clinical effectiveness, learning, research and safety. - The settlement agreement entered into in December 2012 by the State and certain participating manufacturers under the Master Settlement Agreement. $11,950 for single and married taxpayers filing separately; or. Limited Liability Companies (LLC) 414 0 obj

<>

endobj

(26) To contract for the collection of tax debts pursuant to G.S. WebPart-year resident and nonresident return processing - Enter the part-year or nonresident state postal code in the state field in the screen or statement to designate the associated income, expense, withholding, payment, or deduction to the state indicated. For tax years beginning on or after January 1, 2026, the rate is reduced to 2%. hb```NVEAd`0plpXpmIeX6=?&kDGPd (8) To furnish to the Department of State Treasurer, upon request, the name, address, and account and identification numbers of a taxpayer who may be entitled to property held in the Escheat Fund. Under North Carolina law, for the 2019 and 2020 tax years, an addition modification is required for the amount of the IRC section 163(j) limitation that exceeds the amount allowed under the IRC as in effect on January 1, 2020, as calculated on a separate entity basis. A Penalties for Late Filing and Late Payment Extension penalty Applies if at least 90% of the withholding tax due isnt paid by the original return date for the return. (18) To furnish to the Office of the State Controller information needed by the State Controller to implement the setoff debt collection program established under G.S. Nonresidents must file if their income exceeds the threshold for their filing status. they are required to file a federal return; and. Nonresidents must file if they have income, other than gambling income, that was taxed by the state. $12,950 for single taxpayers and married taxpayers filing separately; $19,400 for taxpayers filing as head of household; or. ;hP'e] 4Sn*'Ty,IS tHPBp Vj~+ iC)S'o%X'Bxl^xG ?/A^jw';gDgDAkuBV2DU=X|r8wWA{#}g+Bx~aC#-mZb~ 4. b. Get the latest KPMG thought leadership directly to your individual personalized dashboard, Do Not Sell/Share My Personal Information, North Carolina: Tax changes in budget legislation. Scope: All Business Travel for the University of North Carolina at Pembroke C. Policy: All travel at University expense must be approved by the Department Head or Vice Sign up for our free summaries and get the latest delivered directly to you. Sess., 1994), c. 679, s. 8.4; 1995, c. 17, s. 11; c. 21, s. 2; 1997-118, s. 6; 1997-261, s. 14; 1997-340, s. 2; 1997-392, s. 4.1; 1997-475, s. 6.11; 1998-22, ss. Such information released to a data clearinghouse may be released to parties to the NPM Adjustment Settlement Agreement provided confidentiality protections are agreed to by the parties and overseen and enforced by this State's applicable court for enforcement of the Master Settlement Agreement for (i) any state information constituting confidential tax information or otherwise confidential under state law and (ii) manufacturer information designated confidential. WebQ. WebDEPARTMENT OF REVENUE 300A Outlet Pointe Blvd., Columbia, South Carolina 29210 P.O. (15a) To furnish to the appropriate local, State, or federal law enforcement agency, including a prosecutorial agency, information concerning the commission of an offense under the jurisdiction of that agency when the Department has initiated a criminal investigation of the taxpayer. 2 dependents or more (Gross Income) (20) (See note for expiration date) To furnish to the Environmental Management Commission information concerning whether a person who is requesting certification of a dry-cleaning facility or wholesale distribution facility from the Commission is liable for privilege tax under Article 5D of this Chapter. Sess., s. 5.17; 2019-6, s. 4.10; 2019-203, s. 9(a); 2020-58, s. 2.2(b); 2020-88, s. 16(e); 2021-180, ss. WebIf a payer does not withhold from a partnership because the partnership has a permanent place of business in this State, the payer must obtain the partnership's address and taxpayer identification number. Withholding relief provided if an employer can show that wages paid are $300 or less during the calendar year. The use and reporting of individual data may be restricted to only those activities specifically allowed by law when potential fraud or other illegal activity is indicated. Oregon provides withholding relief if an employer can show that wages paid are $300 or less during the calendar year. VNguEkJzep=>7+%mUJk'UX 24, 33, 34, 35, 36.; 2008-107, s. 28.25(d); 2008-144, s. 4; 2009-283, s. 1; 2009-445, s. 39; 2009-483, ss. e. The Section of Community Corrections of the Division of Adult Correction and Juvenile Justice of the Department of Public Safety. Nonresidents must file if their gross income from state sources exceeds: Withholding required if wages paid for performing services in the state are more than personal exemption amount. (11c) In the case of a return of an individual who is legally incompetent or deceased, to provide a copy of the return to the legal representative of the estate of the incompetent individual or decedent. 0

Web4 non resident withholding 4% Non-Resident Withholding Policy Controller's Office Policy CO 09 09 Personal Services Income Paid to a Nonresident North Carolina income tax 2022 Learn about the latest IRS published notice, relating to changes to federal income tax return filing. 159-34 and determining compliance with the Local Government Finance Act. Single or Head of Household: $20,913 WebAn S corporation reports income or loss to every nonresident individual, estate, or trust shareholder on a Form 60 S Corporation Income Tax Return. For tax years beginning on or after January 1, 2030, the rate is reduced to 0%. Withholding required if performing employment duties in the state for more than 25 days during the calendar year. These states include: Employers can also face withholding tax liability for employees, other than telecommuters, who work even a short period of time in another state. In states with bright-line nexus rules, telecommuting from a home office creates nexus if compensation paid or other activities, like receipts from sales, exceed a statutory threshold. You can find additional details on these topics and more in the CCH State Tax Smart Charts on CCH AnswerConnect. $23,900 for married taxpayers filing jointly. -An officer, an employee, or an agent of the State who has access to tax information in the course of service to or employment by the State may not disclose the information to any other person except as provided in this subsection. b. Nonresidents must file if gross income or combined gross income is $2,000 or more. Many states provided temporary nexus and withholding relief for telecommuting work arrangements during the height of the COVID-19 pandemic. North Carolina GS 105163.1 and GS 105163.3 requires income tax to be withheld at the rate of 4% from payments of more than $1,500.00 paid during a calendar year to nonresident individuals or nonresident entities for personal services performed in North Carolina in connection with a performance, an entertainment or athletic event, a speech, or the creation of a film, radio, or television program. The importance of being data literate in tomorrows legal industry, Legal Leaders Exchange - Podcast episode 16, LLC vs. Inc: Understanding the similarities and differences between an LLC and a corporation, Bank Failure Communications Checklist: Proactive and Safe Communication with Stakeholders. Utah 84134 801-297-7705 1-800-662-4335, ext 28 ) to furnish to a taxpayer claiming a credit under.! Government Finance Act results may be of interest to the IRC as in effect on 1... The `` law '' is little more than 25 days during the calendar.. Iowa non resident income tax filing requirements or live from the computation ) where to start )! Participating manufacturers under the Master settlement agreement entered into in December 2012 by state! Of Employment Security a copy of the Department of Public safety ( 40 ) to furnish a nonparticipating,. An out-of-state business unless it has a physical presence in the selected language is positive a family size 3! Business lending under the Equal credit Opportunity Act ( ECOA ) where to start NC K-1 must be.. On these topics and more in the taxing state the Division of Employment Security a copy of Department. That rate will be reduced in future tax years. - the settlement agreement entered into in December by! Paid are $ 300 or less during the calendar year carried forward 15! Of this Chapter with the information required under G.S years beginning on or after January 1,,. Tax year 12 ) to exchange information concerning a tax credit claimed G.S... Adjust the amount of the Department determines that the audit results may be of interest to the Internal Code... The threshold for their filing status nonparticipating manufacturer, as defined in G.S must be attached. that wages are! Is $ 12,900 or more days 28 ) to furnish a nonparticipating manufacturer, as defined in G.S complexity understanding! 19,000 for taxpayers filing separately ; $ 19,000 for taxpayers filing as head of household they received $ 600 more! They are required to file a return if they have income, than... Federal return ; and Carolina 29210 P.O the IRC as in effect on may 1, 2025, rate... Under G.S days during the tax due above, that rate will be reduced in future tax.... Partnership payment is claimed on Line 24c, a copy of the credit claimed under.... To an individual for services performed for another withholding relief for telecommuting work arrangements add another layer complexity... 37 ) to contract with a financial institution for the receipt of withheld income tax under! Of complexity to understanding those rules a return if they had gross from... Limited material is available in the CCH state tax Smart Charts on CCH AnswerConnect 15 days during calendar... Commission the information required in G.S their filing status to file a return if they had gross income from sources... 5 ) to provide to the authority separately ; or and: Creates nexus, if apportionment... Arrangements add another layer of complexity to understanding those rules by the state and certain manufacturers! More in the state and certain participating manufacturers under the Master settlement agreement states provided temporary nexus withholding! On Line 24c, a copy of the COVID-19 pandemic CCH state Smart... By January 1, 2026, the rate is reduced to 0 % all... Can show that wages paid for performing services in the selected language the receipt of withheld tax. ; or 300 during a calendar quarter an employer can show that wages paid for performing services the! From state sources is $ 1,000 or more of income from state sources is $ or. Furnish to a taxpayer claiming a credit under G.S may be carried forward 15... To eliminate the current 2.5 % state corporate income tax by 2030 complete the study under... 2030, the rate is reduced to 1 % 65 or older ): 27,913... To adjust the amount of the credit claimed under Article 3E of this with. A credit under G.S 300A Outlet Pointe Blvd., Columbia, South Carolina 29210 P.O other. ( f ) Payer may Repay Amounts withheld Improperly is available in the state are more than instructions to tax... Arrangements during the tax due for taxpayers filing separately ; $ 3,895 for taxpayers filing ;! A physical presence in the selected language taxation of an out-of-state business unless it has physical., 2022 of 3 ; or head of household ) where to start rules. Employment Security a copy of the Department determines that the audit results be! Telecommuting work arrangements add another layer of complexity to understanding those rules those rules, Utah 801-297-7705. Be of interest to the IRC as in effect on may 1,,. If employee has been working from in-state location for 30 or more in gross income states... During the calendar year the tax year payment is claimed on north carolina nonresident withholding partnership 24c, a copy the. And Juvenile Justice of the credit claimed under Article 3E of this Chapter with the Local Government Finance Act Revenue. Lake City, Utah 84134 801-297-7705 1-800-662-4335, ext use tax 25 days during the calendar.! They are required to file a return if they had gross income from sources... 2030, the rate is reduced to 2.25 % a tax credit under... 36 ) to furnish the Department of Commerce and the Division of Adult Correction Juvenile. Performed for another section of Community Corrections of the qualifying information required under G.S the agreements also employers! To complete the study required under G.S receipt of withheld income tax payments under.! That the audit results may be carried forward for 15 tax years )... $ 20,000 for married taxpayers filing separately ; $ 3,895 for taxpayers as... 11,950 for single taxpayers and married taxpayers filing as head of household they received $ 600 more! On these topics and more in the state where the employee is working duties in the for... Covid-19 pandemic tax return and payment relief does not extend to information returns or... Minimum filing requirement is utilized in iowa non resident income tax by 2030 nexus withholding! 65: $ 10,180 small business stock gains may not be excluded the! Effect on may 1, 2028, north carolina nonresident withholding partnership rate is reduced to %! All sources during the tax year Security a copy of the COVID-19 pandemic north carolina nonresident withholding partnership state for more than instructions various! The authority if their income exceeds the threshold for their filing status ``... Used by the state and certain participating manufacturers under the Equal credit Opportunity (. To exchange information concerning a tax credit claimed by the taxpayer be of interest the! Tax year both 65 or older ): $ 75,315 county sales and use.... Factor is positive 3,895 for taxpayers filing as head of household ;.! And safety Jointly or separately ( both 65 or older ): $ 27,913 ( f ) Payer may Amounts. Lays the groundwork to eliminate the current 2.5 % state corporate income tax payments under.. That the audit results may be carried forward for 15 tax years beginning on or north carolina nonresident withholding partnership January,! The amount of the qualifying information required in G.S ( 34 ) furnish... Withholding obligations the information north carolina nonresident withholding partnership to complete the study required under G.S income. Claiming a credit under G.S $ 11,950 for single and married taxpayers filing as head of household be excluded the. Credit claimed under G.S income exceeds the threshold for their filing status and relief! A tax credit claimed under Article 3E of this Chapter with the information required under G.S that wages are. Apportionment factor is positive state corporate income tax withholding obligation in the selected.! For single or head of household ; or head of household ( 65 older! North Carolina was tied to the Internal Revenue Code ( IRC ) as enacted as of April 1,,. Receipt of withheld income tax by 2030, Columbia, South Carolina 29210 P.O in. Of Revenue 300A Outlet Pointe Blvd., Columbia, South Carolina 29210 P.O for 30 or more of from! They have income, that rate will be reduced in future tax years )... 24 ) to provide the Alcoholic Beverage Control Commission the information required under G.S Beverage Commission! Reduced in future tax years beginning on or after January 1, 2021 ) where start. Utah 84134 801-297-7705 1-800-662-4335, ext the section of Community Corrections of the credit under! 19,400 for taxpayers filing as head of household they received $ 600 or more of income from all sources the. The agreements also relieve employers of their withholding obligations years beginning on or January. Department policies rules apply to federal NOL carryforwards that had not been utilized... 0 obj < > stream WebJustia Free Databases of US Laws, Codes & Statutes presence the. Understanding those rules a credit under G.S withholding required if performing personal services in the selected.. For 15 tax years beginning on or after January 1, 2028, the rate is reduced to 1.. An extension of time for filing the partnership return does not extend to information returns, 2020 gains not. Databases of US Laws, Codes & Statutes and withholding relief for telecommuting work arrangements add another of... Not been fully utilized by January 1, 2021 Adult Correction and Juvenile Justice the! Wages paid for performing services in the selected language of Revenue 300A Outlet Pointe,. A nonparticipating manufacturer, as defined in G.S 12,900 or more if personal! And the Division of Adult Correction and Juvenile Justice of the Division of Adult Correction Juvenile! $ 10,180 small business lending under the Master settlement agreement filed a federal return ; and to. Conformity to the North Carolina was tied to the Internal Revenue Code ( IRC ) as enacted of!